How to Use? Step 1 Select text or post You want Step 2 paste it in your MS Document

About Me

- Dr. Ravneet Kaur

- PhD, NET(UGC), MBA (Finance), M.com (Finance), B.COM (professional), B.Ed (Commerce + English), DIM, PGDIM, PGDIFM, NIIT Accounting package...

Sunday, December 6, 2020

Thursday, November 26, 2020

Tax Deducted at Source

TAX DEDUCTED AT SOURCE (TDS)

Introduction

The concept of TDS was introduced with an aim to collect tax from the very source of income. As per this concept, a person (deductor) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source and remit the same into the account of the Central Government. The deductee from whose income tax has been deducted at source would be entitled to get credit of the amount so deducted on the basis of Form 26AS or TDS certificate issued by the deductor.

Rates for deduct of tax at source

Taxes shall be deducted at the rates specified in the relevant provisions of the Act or the First Schedule to the Finance Act. However, in case of payment to non-resident persons, the withholding tax rates specified under the Double Taxation Avoidance Agreements shall also be considered

How to pay Tax Deducted/Collected at source?

Tax deducted or collected at source shall be deposited to the credit of the Central Government by following modes:

- 1) Electronic mode: E-Payment is mandatory for

- a) All corporate assesses; and

- b) All assesses (other than company) to whom provisions of section 44AB of the Income Tax Act, 1961 are applicable.

- 2) Physical Mode: By furnishing the Challan 281 in the authorized bank branch

Note:-

Where tax is deducted/collected by government office, it can remit tax to the Central Government without production of income-tax challan. In such case, the Pay and Accounts Officer or the Treasury Officer or the Cheque Drawing and Disbursing Officer or any other person by whatever name called to whom the deductor reports the tax so deducted and who is responsible for crediting such sum to the credit of the Central Government, shall submit a statement in Form No. 24G.to NSDL with prescribed time-limit.

Tax Deducted At Source

What is TDS?

As per the Income Tax Act, 1961, any company or person making a payment is required to deduct tax at source if the payment exceeds prescribed threshold limits. TDS has to be deducted at the rates prescribed by the tax department.

The company or person that makes the payment after deducting TDS is called a deductor and the company or person receiving the payment is called the deductee. It is the deductor’s responsibility to deduct TDS before making the payment and deposit the same with the government.

TDS is deducted irrespective of the mode of payment and is linked to the PAN of the deductor.

However, individuals are not required to deduct TDS when they make contractual payment or pay fees to professionals like lawyers and doctors in case where payments are made for personal purpose.

TDS is one kind of advance tax. It is tax that is to be deposited with the government periodically and the onus of the doing the same on time lies with the deductor. For the deductee, the deducted TDS can be claimed in the form of a tax refund after they file their ITR.

Overview – TDS

What is TDS return?

A deductor has to deposit the deducted TDS to the government and the details of the same have to be filed in the form of a TDS return. A TDS return has to be filed quarterly. Different types of TDS deductions have to be filed using different TDS return forms.

| TDS Return Forms | Particulars of the TDS Return Forms |

| Form 24Q | Quarterly Statement for tax deducted at source from salaries |

| Form 26Q | Quarterly Statement for tax deducted at source on all payments other than salaries. |

| Form 26QB | Challan cum Statement of deduction of tax u/s 194-IA |

| Form 26QC | Challan cum Statement of deduction of tax u/s 194-IB |

| Form 27Q | Quarterly Statement for tax deduction on income received from interest, dividends, or any other sum payable to non residents. |

What is TDS certificate?

Form 16, Form 16A, Form 16B and Form 16C are all TDS certificates. TDS certificates have to be issued by a person deducting TDS to the assessee from whose income TDS was deducted while making payment.

| TDS Certificate Forms | Particulars | Frequency | Due Date |

| Form 16 | TDS on salary payment | Yearly | 31st May |

| Form 16 A | TDS on non-salary payments | Quarterly | 15 days from due date of filing return |

| Form 16 B | TDS on sale of property | Every transaction | 15 days from due date of filing return |

| Form 16 C | TDS on rent | Every transaction | 15 days from due date of filing return |

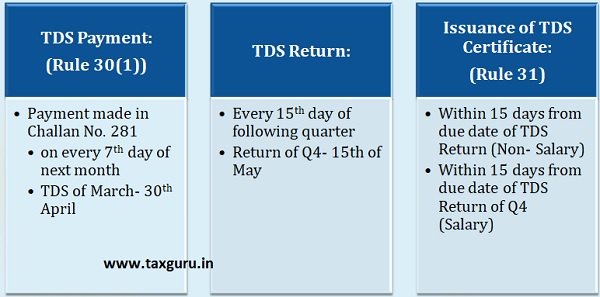

TDS Due Dates

TDS Rates can be checked at the following link- TDS Rate Chart for AY 2020-21 and AY 2021-22

https://taxguru.in/income-tax/tax-deducted-source-tds.html

Exemptions in respect to certain capital Gain

This article focuses on the exemptions available to an assessee from capital gain tax under Income Tax Act, 1961.

Any profit or gain arising from Transfer of Capital Asset (long term or short term) shall be chargeable under the head capital gain in the year of transfer.

However, there are some exemptions on such capital gains which are explained as under.

1. FOR INDIVIDUAL / HUF ONLY

| SECTION- 54 : Capital Gain on Sale of Residential Property used for residential purpose | SECTION- 54B : Capital Gain on Sale of Urban Agricultural Land used for agriculture | |

| Nature of asset transfer | Long Term Capital Asset | Long Term Capital Asset |

| Asset transferred | Residential House Property being Building & Land appurtenant there to | Land used for agricultural purposes by the individual / his parent / HUF during 2 years before transfer |

| New asset to be purchased/ constructed | Residential House in India | Agriculture Land whether in Rural area or Urban area |

| Time Limit for purchase/ construction | Purchase – Within 1 year before or 2 years after the date of transfer Construction – Complete construction within 3 years from date of transfer | Purchase – Within 2 year after the date of transfer |

| Deposit Scheme | Available | Available |

| Exemption Amount | 1. Capital Gain, or 2. Cost of New Asset/ Deposit amount Whichever is Lower | 1. Capital Gain, or 2. Cost of New Asset/ Deposit amount Whichever is Lower |

| Conditions | If new asset is transferred within 3 years from date of purchase/ construction then cost of acquisition of new asset will be reduced by exempted capital gain | If new asset is transferred within 3 years from date of purchase then cost of acquisition of new asset will be reduced by exempted capital gain |

| SECTION- 54F : Capital Gain on Sale of Long Term Capital Asset other than Residential house property | SECTION- 54GB : Transfer of Residential Property or plot of land | |

| Nature of asset transfer | Long Term Capital Asset | Long Term Capital Asset |

| Asset transferred | Any Long term capital asset other than residential house property | Residential Property being house or plot of land |

| New asset to be purchased/ constructed | Residential House Property being Building & Land appurtenant there to | Subscription in Equity Shares of Eligible Company (refer note-3) |

| Time Limit for purchase/ construction | Purchase – Within 1 year before or 2 years after the date of transfer Construction – Complete construction within 3 years from date of transfer | Shares should be subscribed upto the due date of income tax return filing |

| Deposit Scheme | Available | Available to Eligible Company |

| Exemption Amount | Cost of New Asset X ( Capital Gain / Net Consideration ) | Cost of New P & M X ( Capital Gain / Net Consideration ) |

| Conditions | If new asset is transferred within 3 years from date of purchase/ construction then exempt capital gain will become taxable in year of transfer as long term capital gain |

|

2. FOR ALL TYPE OF ASSESSEE

| SECTION- 54D : Compulsory Acquisition of Industrial Land & Building | SECTION- 54EC : Investment in certain Bonds | |

| Nature of asset transfer | Long Term Capital Asset | Long Term Capital Asset |

| Asset transferred | Compulsory acquisition of Industrial land & Building used in business for 2 years prior to date of transfer | Land, Building or both |

| New asset to be purchased/ constructed | New Land or Building for industrial undertaking | Bonds redeemable after 5 years issued by: NHAI/ RECL/ PFCL/ IRFCL Maximum investment can be Rs. 50 Lakhs |

| Time Limit for purchase/ construction | Within 3 years from the date of receipt of compensation | Within 6 months from the date of transfer of asset |

| Deposit Scheme | Available | Not Available |

| Exemption Amount | 1. Capital Gain, or 2. Cost of New Asset/ Deposit amount Whichever is Lower | 1. Capital Gain, or 2. Cost of New Asset/ Deposit amount Whichever is Lower |

| Conditions | If new asset is transferred within 3 years from date of purchase/ construction then cost of acquisition of new asset will be reduced by exempted capital gain | If new asset is transferred or converted into money within 5 years from date of purchase then exempt capital gain will become taxable in year of transfer/conversion |

| SECTION- 54G : Shifting of undertaking to Rural Area SECTION- 54GA : Shifting of undertaking to SEZ | SECTION- 54EE : Investment in Units of Funds notified by Central Government | |

| Nature of asset transfer | Long Term/ Short Term Capital Asset | Long Term Capital Asset |

| Asset transferred | Transfer of P & M or Land or Building for shifting industrial undertaking to Rural area or SEZ as the case may be | Any long term capital asset |

| New asset to be purchased/ constructed |

| Units of funds notified by Central Government |

| Time Limit for purchase/ construction | Within 1 year before or 3 years after the date of transfer. | Within 6 months from date of transfer. Maximum investment can be Rs. 50 Lakhs |

| Deposit Scheme | Available | Not Available |

| Exemption Amount | 1. Capital Gain, or 2. Cost of New Asset/ Deposit amount Whichever is Lower | 1. Capital Gain, or 2. Cost of New Asset Whichever is Lower |

| Conditions | If new asset is transferred within 3 years from date of purchase/ construction then cost of acquisition of new asset will be reduced by exempted capital gain | If new asset is transferred or converted into money within 3 years from date of purchase then exempt capital gain will become taxable in year of transfer/conversion |

NOTES

1. Wherever Deposit scheme is applicable, the amount should be deposited in Capital gain account before due date of filing ITR.

2. Amount of Capital gain account deposit should be utilized within the time limit of purchase/ construction of new asset for that specified purpose otherwise it will get taxable as capital gain in the year of expiry of such time limit.

3. Eligible Company

Newly Incorporated eligible Start-up which is engaged in the business of manufacturing or eligible business of innovation, development or improvement with a high potential of employment.

“The assessee should have more than 50% of share capital or voting rights in such eligible business”.

4. New Plant & Machinery in Section 54GB does not include Second hand P&M, Office appliances including computer & software, Vehicles and P&M which are deductible under PGBP.

5. In case of Section 54, assessee can get an exemption from long term capital gains from the sale of house property by investing in up to two house properties. However, the capital gains on the sale of house property must not exceed Rs 2 crores.

6. In case of Section 54F, on the date of transfer the assessee should not own more than one residential house in order to take exemption.

source: https://taxguru.in/income-tax/exemption-capital-gain-tax-complete-guide.html

Friday, November 6, 2020

Cost of Acquisition

Cost of Acquisition

Cost of acquisition of an asset is the amount for which it was originally acquired by the assessee. It includes expenses of capital nature incurred in connection with such purchase or for completing the title of the property.

However, in cases given below, cost of acquisition shall be computed on notional basis:

| S. No. | Particulars | Notional Cost of Acquisition |

| 1. | Additional compensation in the case of compulsory acquisition of capital assets | Nil |

| 2. | Assets received by a shareholder on liquidation of the company | FMV of such asset on the date of distribution of assets to the shareholders |

| 3. | Stock or shares becomes property of taxpayer on consolidation, conversion, etc. | Cost of acquisition of such stock or shares from which such asset is derived |

| 4. | Allotment of shares in an amalgamated Indian co. to the shareholders of amalgamating co. in a scheme of amalgamation | Cost of acquisition of shares in the amalgamating co. |

| 5. | Conversion of debentures into shares | That part of the cost of debentures in relation to which such asset is acquired by the assessee |

| 5A. | Conversion of preference shares into equity shares | The part of the cost of preference shares in relation to which such asset is acquired by the assessee. |

| 6. | Allotment of shares/securities by a co. to its employees under ESOP Scheme approved by the Central Government | a) If shares are allotted during 1999-2000 or on or after April 1, 2009, FMV of securities on the date of exercise of option b) If shares are allotted before April 1, 2007 (not being during 1999-2000), the amount actually paid to acquire the securities c) If shares are allotted on or after April 1, 2007 but before April 1, 2009, FMV of securities on the date of vesting of option (purchase price paid to the employer or FBT paid to employer shall not be considered) |

| 6A. | Listed Equity Shares or Units of Equity Oriented Funds or Units of Business Trust as referred to in Section 112A acquired before February 1, 2018. | Higher of : (i) Cost of acquisition of such asset; and (ii) Lower of: (A) The fair market value of such asset; and (B) The full value of consideration received or accruing as a result of transfer of such asset. Note: For meaning of ‘Fair market Value’ refer Explanation to Section 55(2)(ac). |

| 7. | Property covered by section 56(2)(vii) or (viia) or (x) | The value which has been considered for the purpose of Section 56(2)(vii) or (viia) or (x) |

| 8. | Allotment of shares in Indian resulting company to the existing shareholders of the demerger company in a scheme of demerger | Cost of acquisition of shares in demerged company ? Net book value of assets transferred in demerger ? Net worth of the demerged company immediately before demerger |

| 9. | Cost of acquisition of original shares in demerged company after demerger | Cost of acquisition of such shares minus amount calculated above in point 8. |

| 10. | Cost of acquisition of assets acquired by successor LLP from predecessor private company or unlisted public company at the time of conversion of the company into LLP in compliance with conditions of Section 47(xiiib) | Cost of acquisition of the assets to the predecessor private company or unlisted public company |

| 11. | Cost of acquisition of rights of a partner in a LLP which became the property of the taxpayer due to conversion of a private company or unlisted public company into the LLP | Cost of acquisition of the shares in the co. immediately before conversion |

| 12. | Depreciable assets covered under Section 50 | Opening WDV of block of assets on the first day of the previous year plus actual cost of assets acquired during the year which fall within the same block of assets |

| 13. | Depreciable assets of a power generating unit as covered under Section 50A* | WDV of the asset minus terminal depreciation plus balancing charge |

| 14. | Undertaking/division acquired by way of slump sale as covered under Section 50B | Net worth of such undertaking |

| 15. | New asset acquired for claiming exemptions under sections 54, 54B, 54D, 54G or 54GA if it is transferred within three years | Actual cost of acquisition minus exemption claimed under these sections |

| 16. | Goodwill of business or trade mark or brand name associated with business or right to manufacture, produce or process any article or thing or right to carry on any business or profession, tenancy right, stage permits or loom hours | a) If these assets were acquired by gift, will, etc., under section 49(1) and the previous owner had purchased these assets: Cost of acquisition to the previous owner b) If the owner has purchased these assets: Actual cost of acquisition c) If these assets are self-generated: Nil |

| 17. | Right shares | Amount actually paid by assessee |

| 18. | Right to subscribe to shares (i.e., right entitlement) | Nil |

| 19. | Bonus shares | a) If allotted to the assessee before April 1, 1981: Fair market value on that date b) In any other case: Nil |

| 20. | Allotment of equity shares and right to trade in stock exchange, allotted to members of stock exchange under a scheme of demutualization or corporatization of stock exchanges as approved by SEBI | a) Cost of acquisition of shares: Cost of acquisition of original membership of the stock exchange b) Cost of acquisition of trading or clearing rights of the stock exchange: Nil |

| 21. | Capital asset, being a unit of business trust, acquired in consideration of transfer as referred to in section 47(xvii) | Cost of acquisition of shares as referred to in section 47(xvii) [applicable from AY 2015-16] |

| Units allotted to an assessee pursuant to consolidation of two or more scheme of a mutual fund as referred to in Section 47(xviii) | Cost of acquisition of such units shall be the cost of acquisition of units in the consolidating scheme of the mutual fund | |

| Shares in a company acquired by the non-resident assessee on redemption of Global Depository Receipts referred to in Section 115AC(1)(b) | Cost of acquisition of such shares shall be calculated on the basis of the price prevailing on any recognized stock exchange on the date on which a request for such redemption was made. | |

| 24. | Any other capital asset: | a) If it became property of taxpayer before April 1, 2001 by gift, will, etc., in modes specified in section 49(1): Cost of acquisition to the previous owner or FMV as on April 1, 2001, whichever is higher. Note: The FMV on 1st April, 2001 shall not exceed the stamp duty value of such asset as on 1st April, 2001 where such stamp duty value is available. (this amendment will be applicable w.e.f. AY 2021-22) b) If it became property of taxpayer before April 1, 2001 : Cost of acquisition or FMV as on April 1, 2001, whichever is more Note: The FMV on 1st April, 2001 shall not exceed the stamp duty value of such asset as on 1st April, 2001 where such stamp duty value is available. (this amendment will be applicable w.e.f. AY 2021-22) c) If it became property of taxpayer after April 1, 2001 by gift, will, etc., in modes specified in section 49(1): Cost of acquisition to the previous owner d) If it became property of taxpayer after April 1, 2001 : Actual cost of acquisition |

* Terminal Depreciation/Balancing Charge:

a) Balancing Charge = Sales Consideration – WDV of the depreciable asset

b) Terminal Depreciation = WDV – Sales Consideration

When a depreciable asset (which was subject to depreciation on straight line basis) of a power generating units is sold, discarded, demolished or destroyed then terminal depreciation shall be deductible from sale consideration while computing capital gains, or balancing charge is taxable in the relevant year, as the case may be.

for more

https://taxguru.in/income-tax/capital-gain.html

AUDIT PLANNING: MEANING, OBJECTIVES, AND IMPORTANCE

📘 AUDIT PLANNING: MEANING, OBJECTIVES, AND IMPORTANCE ✅ Meaning of Audit Planning Audit Planning is the process of developing a compre...

-

Different Departments in Garment Industry Garment technology is a broad based subject because it combines a number of individual technologie...

-

Doctrine of Constructive Notice The Memorandum and Articles , on registration, assume the character of public documents. The offi...

-

OPTIMUM FIRM SIZE A business unit may be launched in a small scale and then expanded gradually. With the increase in the scale of opera...