How to Upload Invoice to GSTN

To file GSTR-1 return, persons having GST registration must upload details of all their invoices to the GSTN portal. In this article, we look at how to upload invoice to GSTN through multiple modes.

Invoice Details to Be Uploaded to GSTN

Every month to file GSTR-1 return, the taxpayer must upload details of all invoice issued during the last month on the GSTN portal. GSTN does NOT accept image copies of invoices in pdf or jpeg or gif format of any invoice. Only information pertaining to the invoice must be uploaded to GSTN in data format.

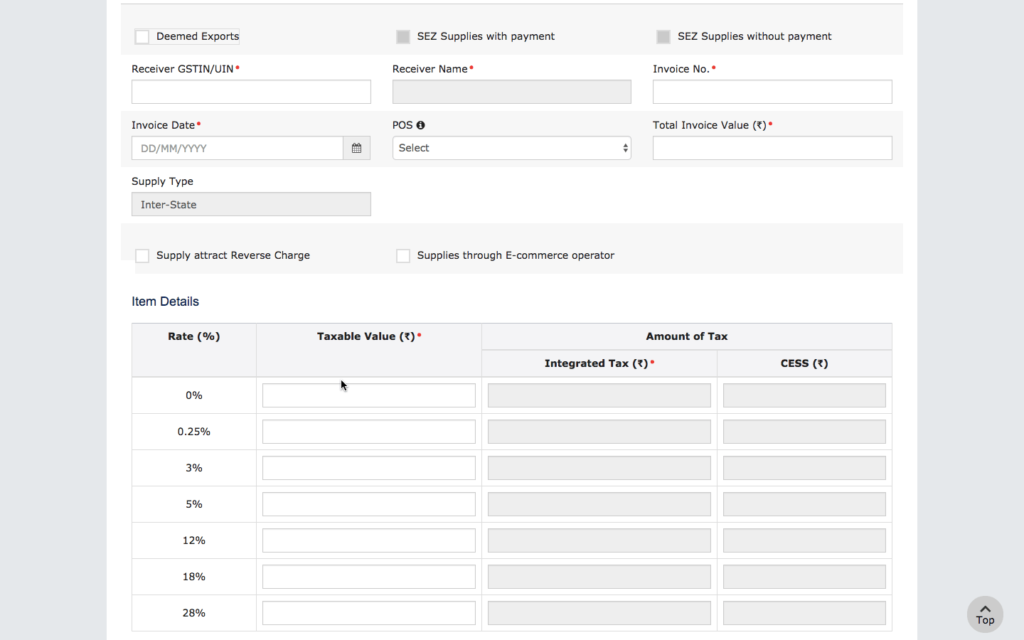

For B2B invoices, the following details must be uploaded on the GSTN:

- Customers GSTIN

- Based on the Customer’s GSTIN, the Customer Name as per GSTN will be completed automatically

- Invoice Number

- Invoice Date

- Place of Supply

- Total Invoice Value

- Supply Type (Inter-State or Intra-State)

- If supply is made through e-commerce operator

- GSTIN of E-Commerce Operator

- If the supply is an export

- If the supply attracts reverse charge

- If the supply was made to a SEZ unit

- GST rate applicable (0%, 0.25%, 3%, 5%, 12%, 18% and 28%). If the invoice has multiple items, then items can be consolidated rate wise.

- Taxable value for each of the GST rate slabs

- Amount of GST applicable (IGST, CGST and SGST)

The screenshot below shows the information to be uploaded for a B2B invoice.

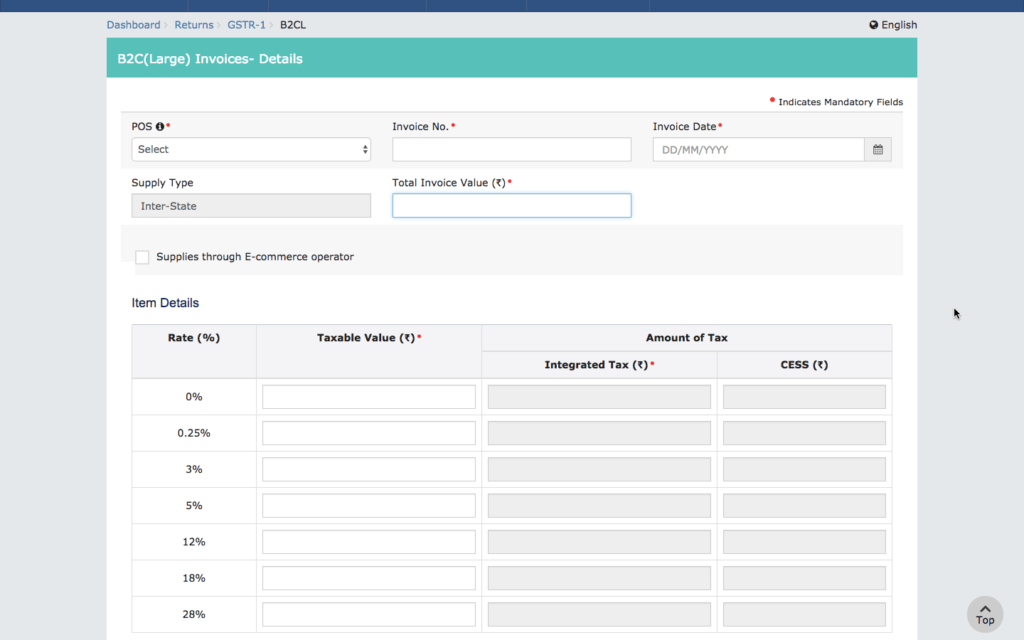

For B2C large invoices, the following details must be uploaded on the GSTN. B2C large invoices are invoices wherein the taxable value is more than Rs.2.5 lakhs.

- Invoice Number

- Invoice Date

- Place of Supply

- Total Invoice Value

- Supply Type (Inter-State or Intra-State)

- If supply is made through e-commerce operator

- GSTIN of E-Commerce Operator

- GST rate applicable (0%, 0.25%, 3%, 5%, 12%, 18% and 28%). If the invoice has multiple items, then items can be consolidated rate wise.

- Taxable value for each of the GST rate slabs

- Amount of GST applicable (IGST, CGST and SGST)

For B2C small invoices, only rate wise consolidated figures need to be uploaded on the GSTN. Hence, individuals invoices need not be uploaded for B2C invoices, wherein the taxable value is less than Rs.2.5 lakhs.

How to Upload Invoice to GSTN

There are multiple ways and tools available for uploading invoices to GSTN as follows:

LEDGERS GST Software

Businesses using LEDGERS GST Software for filing GST returns can upload invoice to GSTN directly from the software. Based on the invoices created on LEDGERS, GSTR-1 will be aut0-prepared. Further, in case other invoices were issued to a customer, they can be uploaded to LEDGERS using the excel upload tool. Once all the invoices for the month are uploaded on LEDGERS, the user can click on GST Filing – GSTR-1 – Overview, to view a summary of GSTR-1.

The user can click on File GSTR-1 to directly file the GST Return on the GST Portal. However, to file directly, the user will have to allow LEDGERS access to the GST Account and verify the same using the OTP generated. Alternatively, the user can also download a JSON file from LEDGERS, containing all the details for filing GSTR-1 along with invoice upload. This file can be uploaded on the GSTN and digitally signed to complete the GST filing through LEDGERS.

ManualOnline Upload of Invoice on GSTN

Users can also manually upload invoice to GSTN portal through their GST account. To manually upload invoice to GSTN, follow the steps below:

Step 1: Login to your GST account

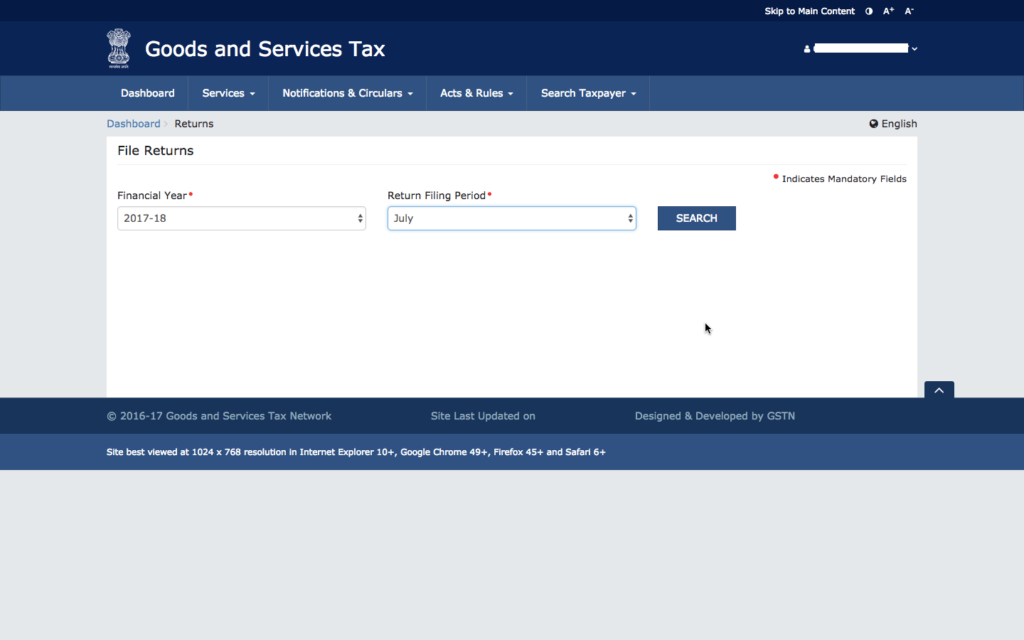

Step 2: Select the month for which you wish to upload GST invoices

Step 3: Select GSTR-1 Return and Click on Prepare Online

Step 4: Upload B2B Invoice Details

Select B2B invoices. Enter details of the invoices one by one, until details of all issued invoices are loaded on the GSTN portal. This method would be suitable only for entities have a few invoices every month. Entities having multiple B2B invoices would find this option time-consuming, as every invoice details must be manually entered into the system.

Step 5: Upload B2C Large Invoice Details

Once all the B2B invoices are uploaded, B2C large invoice details must be loaded. Th procedure for uploading B2C large invoices is relatively simpler, as fewer details are required.

On uploading the B2B invoices and B2C large invoices, the taxpayer is ready to provide other consolidated inforation like B2C small invoice, credit or debit notes, advances received, etc., Hence, only B2B invoice and B2C large invoice data must be uploaded on the GSTN.

Manual Offline Preparation of GST Return

In case you would like to prepare GSTR-1 return manually, you can use the GST offline return tool provided on the GST portal. The GST offline return tool is a .EXE file and works on Windows based computers. In the offline GST return tool, all the required information for GSTR-1 can be populated offline along with invoice upload. Once the details are prepared, the user can click on the download JSON button to get a JSON file with all the B2B invoice data and GSTR-1 return data. This file can be uploaded directly into the GST portal to complete the GST return filing.

https://www.indiafilings.com/learn/upload-invoice-gstn/

No comments:

Post a Comment