Who is a GST Suvidha Provider (GSP)?

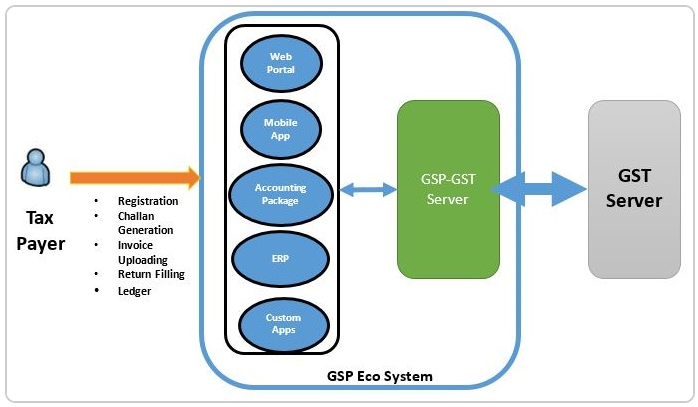

GSP stands for GST Suvidha Provider. A GSP enables a GST taxpayer to comply with all the procedural provisions of the GST law through its web platform. ClearTax, an online tax filing platform has been granted the status of GSP. A GSP provides innovative methods or means of an effective interactive platform for taxpayers to access GST portal services ranging from registration and invoicing to completion of GST return filing.

Understanding with an example:

Let’s take an example to understand it better:

ABC Ltd is a private multinational company, which is running operations on SAP ERP. All records with respect to purchases and sales are maintained in it. At the end of each month, reports are generated from ERP and utilised to prepare and generate tax returns. Thereafter, returns are uploaded on the government’s portal.

Our government is now aiming for single and automated workflow wherein these ERP companies can build an interface with government’s portal and all the GST related compliance can be done directly through their software.

GSP need not be only ERP companies but can be startups or financial technology companies having expertise in building web applications for filing GST returns such as ClearTax.

GSP – A Brainchild of Goods and Services Tax Network

GSP is a term coined by GSTN (Goods and Service Tax Network), the private non-government entity that owns and maintains the GST portal.

It is in-line with the ‘Digital India’ initiative that advocates a paperless tax compliance regime that enables transparency and reliability in doing business across India.

Three Modes of Interaction With GST portal

1) Filing directly on the GST portal

A GST taxpayer will usually access the website directly for availing various services offered on the website such as registration, GST return filing, refund application, and other similar GST compliances. However, for services such as GST return filing, a taxpayer may not be technically equipped to file online. Hence, they may find it difficult to collate sales and purchase data from his ERP system or accounting software in the required GSTN format. A lot of manual efforts may go into preparing the GST returns. Hence, a GST Suvidha Provider is an indirect means yet an easy platform to access the GST portal saving time and efforts.

Under indirect means, there are two types of intermediaries between the taxpayer and the GST portal. They are as follows:

2) ASP who is not a GSP:

These entities provide the requisite third-party applications for GST compliance. They have user interfaces via various modes such as desktop, mobile or any other interfaces for taxpayers just like any other Application Service Provider (ASP). Such an application developer can connect with the GST portal via a secure GST system Application Programming Interface (APIs) accessed with the help of GST Suvidha Providers.

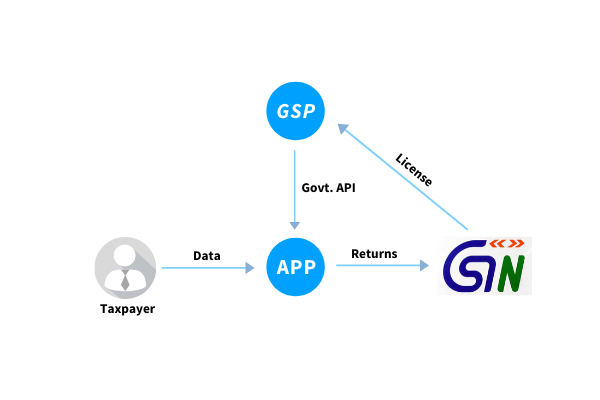

The below diagram will show the two ways of how the taxpayers can access the GST portal indirectly through an ASP who is Non-GSP:

3) ASP who is also a GSP:

A government-approved application service provider is the most reliable mode of completing GST compliances. They provide the application and are also authorised to provide an interactive platform to access the GST portal. Such an ASP who is also a GST Suvidha Provider can connect seamlessly with the GST portal and helps avoid; any third-party dependency, thereby increasing the speed of processing of data. Also, an ASP which has access to multiple GSPs will ensure higher uptime availability and scalability for the user.

The below diagram will show the two ways of how the taxpayers can access the GST portal indirectly through an ASP who is also a GSP:

Interaction of a taxpayer with the GST portal can, therefore, take place via either of the three routes as follows:

Areas addressed by GST Suvidha Providers

- Upload invoice data (B2B and large value B2C).

- Upload GSTR-1 (return containing supply data), which will be created based on invoice data and some other data provided by the taxpayer.

- GSTR-2A download and reconciliationwith purchase data accounted on ERP.

- File GSTR-3B based on the GSTR-1 filed, purchase data on record and GSTR-2A information available.

- Similarly, there are other returns for other categories of taxpayers like casual taxpayer or composition taxpayers.

List of GSPs in India

Till November 2019, there have been three rounds of licensing for GST Suvidha Provider. In the first round of allotment of the license, thirty-four companies were granted GSP license. Read the 1st round of allottees here.

In the next round of licensing, around 42 companies were allotted the status of GSP as listed here.

In the latest round of GSP list announced in November 2019, 10 companies have joined the list as laid down here. ClearTax is a GSP authorised to connect to the GST Network using published APIs.

Benefits of being an ASP who is also a GSP

- Allows an end-to-end integration with any ERP system or accounting software so that data can be fetched automatically.

- Improved and faster performancecompared to any other ASP not being GST Suvidha Provider.

- The integration with the GSTN can allow a smooth flow of data between the application and the GST portal avoiding any third-party dependency.

- A single login is needed to accessdifferent locations (GSTIN) instead of login and logout each time from different locations.

- Better security ensured as all security standards are met and approved by GSTN.

Great article! Your blog provides a clear and informative breakdown of GST registration, making it easy for businesses to understand the process. Your effort in simplifying such an important topic is truly commendable. As a service provider in GST registration, we completely agree on its importance for businesses. Keep up the great work in spreading valuable knowledge! Looking forward to more insightful posts.

ReplyDeleteGreat information! If anyone is looking for GST Registration in Delhi, I recommend Taxgoal. They offer fast and easy GST registration services at affordable prices. Their team is very helpful and professional. You can contact them for quick GST solutions.

ReplyDelete

ReplyDeleteChoosing the Right Accounting Institute in Greater Noida

Helpful comparison! ✅ Students looking for the Best Accounting Institute in Greater Noida should visit IICPA Institute — we provide online and offline classes with live software practice, expert faculty, and job assistance.

Accounting Course

Excel Certification Course

Tally Certification Course

HR Certification Course

Income Tax Certification Course

TDS Computation Course